Aidi — Startup funding (Part I)

Return

It is common knowledge that the life of a business amongst all else is cash -Money. At one point or the other, founders have heard and been told repeatedly that cash is king; the easiest way to go out of business is to run out of cash.

Since funding is paramount to the life of a business, how can founders raise capital since seed stage investment accounted for only 6% of the total funding raised between 2014-2020. What measures can one take to convince investors and then, what qualities do they look out for in a founder

This article explores how to prepare for a funding round, the metrics that convince investors and the qualities they look out for.

- Why is funding so hard?

Fundraising has been described as brutal and is often attributed to be the second hardest thing about starting a business. This is due to a number of reasons, one being the harsh state of the market which most entrepreneurs, especially those without prior startup experience are not prepared for. Another reason can be attributed to the ratio of founders to local venture capitalists/ business angels. Between 2014-2020, only 22% of investment in the region was from African founders.

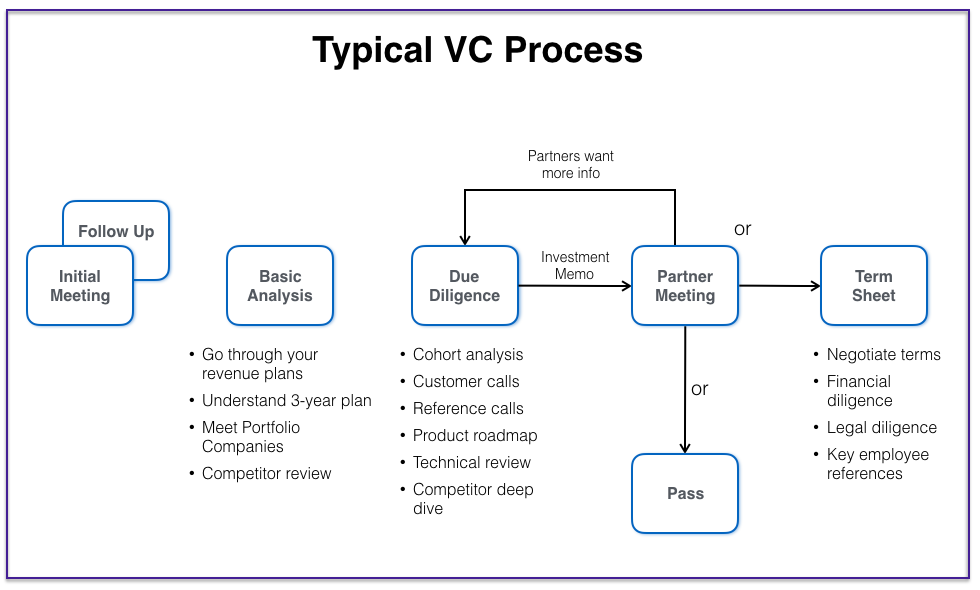

Before we explore how to convince investors, it is important to note that fundraising is not a one-sided affair. It should be mutually beneficial to both parties. A fundraising process can be likened to a sales and marketing activity which needs to be managed. Like in sales, you need to scrutinize your leads/ prospects to see if they will be a good fit for your offering, decide on the amount of time to be dedicated to a prospect and manage your time. This applies to fundraising too - research about your potential investor (the kind of deals they do, companies they have invested in) to see if they will be a fit for your business and map out a time for all negotiations and conversations so your business does not suffer and then manage your time effectively. It is also imperative to understand what a typical VC funding Process is, so you are better prepared

Credit: Mark Suster

With this understanding, here are some other ‘quick’ tips to consider

- Begin early:

It is risky to wait until you have little to zero cash before you begin to seek funding. Doing this will make you take deals and shortcuts that will not be beneficial to the business in the long run, It will also reduce your chances of negotiating with a larger number of potential investors as you should and gives no room to explore other options. Fundraising in time helps your decision-making process (aiding you to make better and more informed resolutions) and gives enough room to consider who to have or not have on your cap table.

- Take pre-funding preparations seriously:

Preparing a perfect pitch deck and curating a list of investors should not be the only effort you make when preparing to raise funding. Make attempts to know the kind of startups they invest in, deals they have done in the past, and the number of partners they have. You can also go a step further by speaking to other founders they have funded to find out how best to work with them.

- Always follow up:

We have established earlier that fundraising can be likened to sales and marketing. A core part of sales and marketing is persistence and follow-up, this applies to fundraising too. As much as video calls are great, following up/ meeting in person is also very recommended. Make it a call of duty to not just have calls and meetings, but to send follow-up emails, and messages- whatever medium is available to you. This does not mean bugging or disturbing them, but communicating when and where necessary.

- Ask for feedback:

You won’t always get a ‘yes’. Oftentimes, the chances of getting initial rejections and no’s are very likely. On occasions where the deal does not come through, ask for feedback regardless. This will help you identify weak areas or gaps you may need to improve at; helping you get better at fundraising and improving the chances of getting a yes and a good deal.

With these tips in mind, how then do you convince an investor? What key areas do they consider before investing in a business? The next article will explore in-depth, the qualities that most investors look out for.